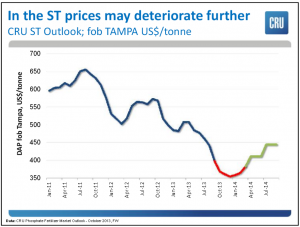

At the recent ANZ fertiliser conference the overseas suppliers gave an overview of the industry generally, looking at supply and demand factors that have been and will have implications for pricing – one that caught my eye was this:

This graph was produced by a company Argus Media, a very experienced fertiliser market commentator (subscription only). If you really want to know on a daily basis what is going on in the fertiliser world, you should subscribe.

What you can see is that while the price of DAP has been falling for many months and perhaps there is room for them to fall a little further over the next 2-3 months, there are factors likely to affect the future pricing and they see the price going up again shortly.

Decisions made around the world by many groups affect farmers day to day – you can see here that the price goes up and down but what is not obvious is what has caused the fluctuations.

Factors that affect price decisions

Many factors can affect price – sometimes quite suddenly. When importers and manufacturers are making fertiliser buying decisions we typically have to assess 3 risk factors –

Currency risk is the chance that a currency will fluctuate sharply. Nearly all fertiliser trade is done in US$. Does that make much difference – it certainly can! Consider an Australian farmer buying 100 tons of DAP overseas as an example. Two months ago that may have cost him about A$54,945. Today, only allowing for currency factors, that same 100 tons would cost about A$51,800,

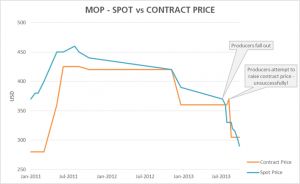

Country (or Political) risk is usually the least risk (in that it happens less frequently) but can have the greatest effect. Recently a virtual war has broken out in the MOP market as two significant export cartel partners fell out – UralKali and BelarusKali (together these 2 supply about 35-40% of the world traded MOP market). The situation has ended up with Russia cutting gas supply to Belarus by 25% (“pipe maintenance”) and blocking supply of Belarussian milk products to Russia (“contamination / safety”). In the meantime the Belarus have the Chairman of the (Russian) Uralkali export company under house arrest in Belarus… and they have started competing in the export market – look at the effect on the export price

Typically potash is traded in 25-50,000 MT ship loads. Imagine how you feel as a fertiliser buyer – you fix the price with your supplier at the best price you can get at a certain moment and yet by the time the cargo arrives at your plant about 8 weeks later it is worth USD 1-2 million less! No fun.

So spare a thought for your fertiliser company if they don’t always get their pricing just right for you. Balancing everything can be quite tricky…!